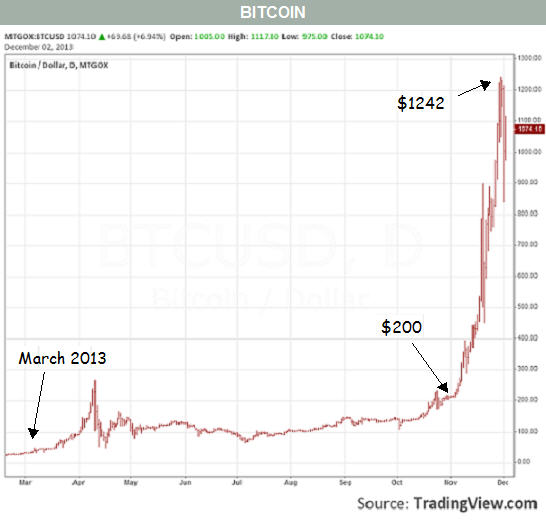

The Bitcoin Bubble

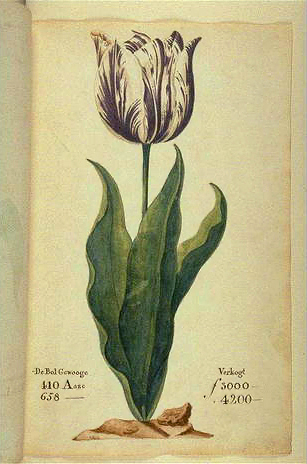

I no longer work as a financial professional. I am a software developer. Nevertheless, a deluge of articles about Bitcoin recently has driven me to write an obligatory blog post memorializing my perspective. Bitcoin is just like the South Sea Bubble and Tulip mania in that the price increases are unsustainable as they are not based on intrinsic value.

“The bubble involves the purchase of an asset, usually real estate or a security, not because of the rate of return on the investment but in anticipation that the asset or security can be sold to someone else at an even higher price; the term the ‘greater fool’ has been used to suggest the last buyer was always counting on finding someone else to whom the stock or the condo apartment or the baseball cards could be sold.” – Charles Kindleberger

A tulip, known as “the Viceroy”, displayed in a 1637 Dutch catalog. Its bulb cost between 3,000 and 4,150 guilders (florins) depending on size. A skilled craftsman at the time earned about 300 guilders a year. (Nusteling, H. (1985) Welvaart en Werkgelegenheid in Amsterdam)

Most of my colleagues are obsessed with Bitcoin. The price is displayed directly below the current time on their Android Watch. They are trying to save up and raise a family, yet any money that they can spare goes toward the latest mining hardware. I wish they would have taken the time to read Benjamin Graham:

There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are:

– speculating when you think you are investing

– speculating seriously when you lack proper knowledge and skill for it

– risking more money in speculation than you can afford to lose

Google Bitcoin and what kind of news stories do you see?

Kentucky police chief to be paid in Bitcoin

“As the virtual currency rockets toward a trading value of $1,200, Tony Vaughn of tiny Kentucky town Vicco is trading in his bank account for a Bitcoin wallet.”

Take it from “The Maestro” who coined the term “Irrational exuberance”:

Greenspan Says Bitcoin a Bubble Without Intrinsic Currency Value

“It’s a bubble. It has to have intrinsic value. You have to really stretch your imagination to infer what the intrinsic value of Bitcoin is. I haven’t been able to do it. Maybe somebody else can.”

People that I look up to are ranting about Why Bitcoin Won’t Be a Bubble, but they are wrong. Bitcoin is the quintessential bubble where expectations about future prices are out of line with reality.